Home Equity Loans and Lines of Credit:

A Better Way to Borrow

Quick and Easy – Flexible terms and low rates. Get funds within 2 weeks!

What Is a Home Equity Loan?

A Home Equity Loan, is a loan that allows you to borrow against the value of your home. This can be a great way to access cash for a variety of purposes, such as home improvements, debt consolidation, or education.

Benefits of a Button Home Equity Loan

How a Home Equity

Loan Works

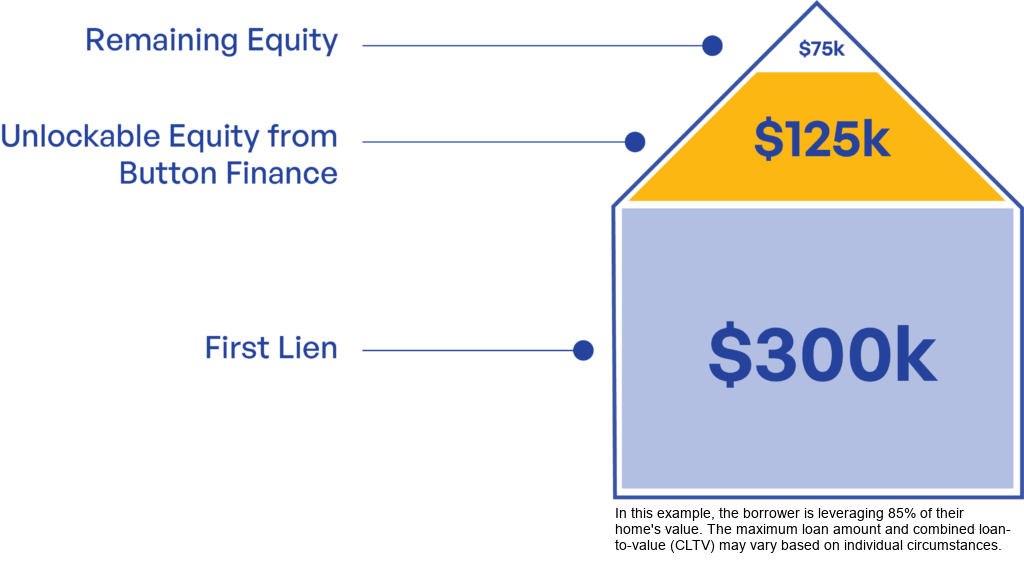

A home equity loan allows you to borrow money against the equity available in your home. At Button Finance, we allow you to borrow up to 85% of your home value.

Don’t Put Your Goals on Hold

Use Your Home to Your Advantage

With a Home Equity Loan loan from Button Finance, achieving your goals can happen sooner

than you thought. Leverage the value of your home and apply for a Home Equity Loan today.

Are you Looking to Partner With Us?

We offer broker and correspondent loan options.